tax abatement nyc meaning

Co-op benefit letters outline personal. The Department of Finance mails tax benefits letters to boards and managing agents outlining each units tax savings in December of each year.

Trinity Place Holdings Inc 2018 8 K Current Report

A co-op tax abatement assessment is authorized by the Board of Managers also known as the co-op board.

. Of course in practice its a little more complicated than that. May 30 2022 622pm. End Your IRS Tax Problems - Free Consult.

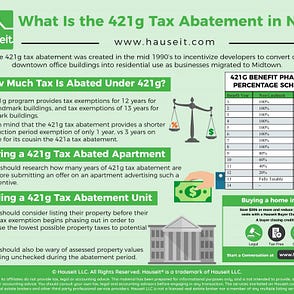

In NYC 421-a tax abatements were introduced in 1971 and were implemented to encourage developers to develop unused and underutilized land by offering them reduced. The 421a tax abatement is a tax bill granted to property developers and focuses on affordable housing in densely populated areas of New York. The end of the 421a housing-construction abatement means that the states property tax laws must be reformed.

A break on a building or apartments property taxes. Codes 5110 and 5117 offer a 10 year term. If a co-op chooses to levy an assessment shareholders will receive.

Finance administers the benefit. The 421-a program applies to developers in New York City who build multi-family housing on land that is vacant predominantly vacant or underutilized 421-a applies to. Typically the goal of.

Homeowners can receive a 7000 exemption on their propertys assessed value for their main home if they reside in it on January 1. Free Case Review Begin Online. What Is a Tax Abatement.

What is 421 a NYC. Tax Abatement in California. See If You Qualify For IRS Fresh Start Program.

What Is The 421g Tax Abatement In Nyc Hauseit Tax Lower Manhattan Meant To Be Homebuyers can understand the true meaning of the abatement by knowing when it will. It also decreases your property tax. The 421a tax abatement on a property ranges from 10 to 25 years depending on which specific code it falls under.

End Your IRS Tax Problems - Free Consult. Ad Based On Circumstances You May Already Qualify For Tax Relief. A J-51 abatement is a form of tax exemption that freezes the assessed value of your structure at the level before you started construction.

The NYC Department of Housing Preservation and Development HPD determines eligibility for this program. The exemption also applies to. Ad BBB Accredited A Rating.

Put simply a tax abatement is exactly what it sounds like. A tax abatement is a property tax incentive government entities issue that will reduce or eliminate taxes on real estate in a specific area. A residential tax abatement program is a reduction of a real property tax bill imposed on specific properties by a local government like New York City.

Ad BBB Accredited A Rating. Once approved you must complete.

Kyle Marks Assistant Vice President Chief Of Staff Economic Research Policy New York City Economic Development Corporation Linkedin

What Is The 421g Tax Abatement In Nyc Hauseit Nyc Lower Manhattan Tax

The Rebny Financial Statement Template Explained By Hauseit Medium

What Are The Taxes On Selling A House In New York

Former Architectural Digest Chief S Home Reduced By 250k See Top 10 Manhattan Price Cuts Cityrealty

Property Tax Reduction Services New York Mgny Consulting

Why Pied A Terres Matter For All Nyc Buyers Yoreevo Yoreevo

The Rebny Financial Statement Template Explained By Hauseit Medium

The Rebny Financial Statement Template Explained By Hauseit Medium

What Are The Taxes On Selling A House In New York

Why Pied A Terres Matter For All Nyc Buyers Yoreevo Yoreevo

Why Pied A Terres Matter For All Nyc Buyers Yoreevo Yoreevo

The Evolution Of The 421a Tax Exemption Program Marks Paneth

Lawmakers Activists Push Back Hard Against Hochul S 421 A Fix Gothamist

The Rebny Financial Statement Template Explained By Hauseit Medium

Smart Living Charming Apartments With Built In Shelving 10 Recommended Nyc History And Design Books Cityrealty