internet tax freedom act texas

Netflix argued that the Texas Services Provider Act didnt apply to streamers that federal law preempts local attempts to impose franchise fees that the Internet Tax Freedom. The Internet Tax Freedom Act ITFA was enacted in 1998 to delay any special taxation of.

Federal law included a grandfather clause for those state.

. It is likely that these taxes cannot be legally imposed on Internet access providers because the. Beginning July 1 2020 Texas will no longer impose sales tax on separately stated internet access charges due to the Internet Tax Freedom Act ITFA of 2016. 105-277 imposed on state and local governments a three-year moratorium from October 1 1998 to October 1 2001 on 1.

Under the grandfather clause included in the Internet Tax Freedom Act Texas is currently collecting a tax on Internet access charges over 2500 per month. Passed the House on July 15 2014 voice vote The Permanent Internet Tax Freedom Act HR. As of July 1 2020.

Moratorium on Certain Taxes - Prohibits a State or political subdivision thereof from imposing the following taxes on Internet. The United States by way of approval by the Senate on February 11 2016 passed. The Internet Tax Freedom Act and Federal Preemption Congress enacted the Internet Tax Freedom Act to establish a moratorium on the imposition of state and local taxes that would.

Internet Tax Freedom Act - Title I. The Internet Tax Freedom Act of 1998 ITFA. On July 1 sales taxes levied on internet access in six statesHawaii New Mexico Ohio South Dakota Texas and Wisconsinwill become illegal under the provisions of the.

105-277 imposed on state and local governments a three-year moratorium from October 1 1998 to October 1 2001 on 1. Texas collected tax on. The new act the Internet Tax Freedom Act Amendments Act of 2007 included a new definition of internet access which means a service that enables users to connect to the Internet to.

The Internet Tax Freedom Act of 1998 ITFA. While the Internet Tax Freedom Act ITFA and its permanent counterpart PIFTA prevents states from imposing taxes on things like actually accessing the internet they do not. Internet Tax Freedom Act - Title I.

Texas does not impose sales tax on separately stated internet access charges due to the Internet Tax Freedom Act ITFA of 2016 effective July 1 2020. Internet access fees are currently subject to state and local sales tax in Hawaii New Mexico Ohio South Dakota Texas and Wisconsin. Federal law included a grandfather.

Little-noticed changes to the Internet Tax Freedom Act made by Congress in 2007 expanding the scope of services preempted from state taxation are at issue in Apple Inc. 3086 is a bill that would amend the Internet Tax Freedom Act to make permanent the ban on. Kentucky Michigan Ohio and Texas have recently enacted gross receipts taxes.

Do You Have To Pay Sales Tax On Internet Purchases Findlaw

How To Start An Llc In Texas Tx Llc Application Zenbusiness Inc

/cloudfront-us-east-1.images.arcpublishing.com/dmn/F2HD6B7WYRCUBEMYPLI6INX3IQ.jpg)

What To Know About Shopping Tax Free In Texas This Weekend

Texas Property Tax Sales In A Hybrid Tax Deed State Ted Thomas

The Ultimate Guide To Internet Sales Tax Small Business Trends

Cell Phone Tax Wireless Taxes Fees Tax Foundation

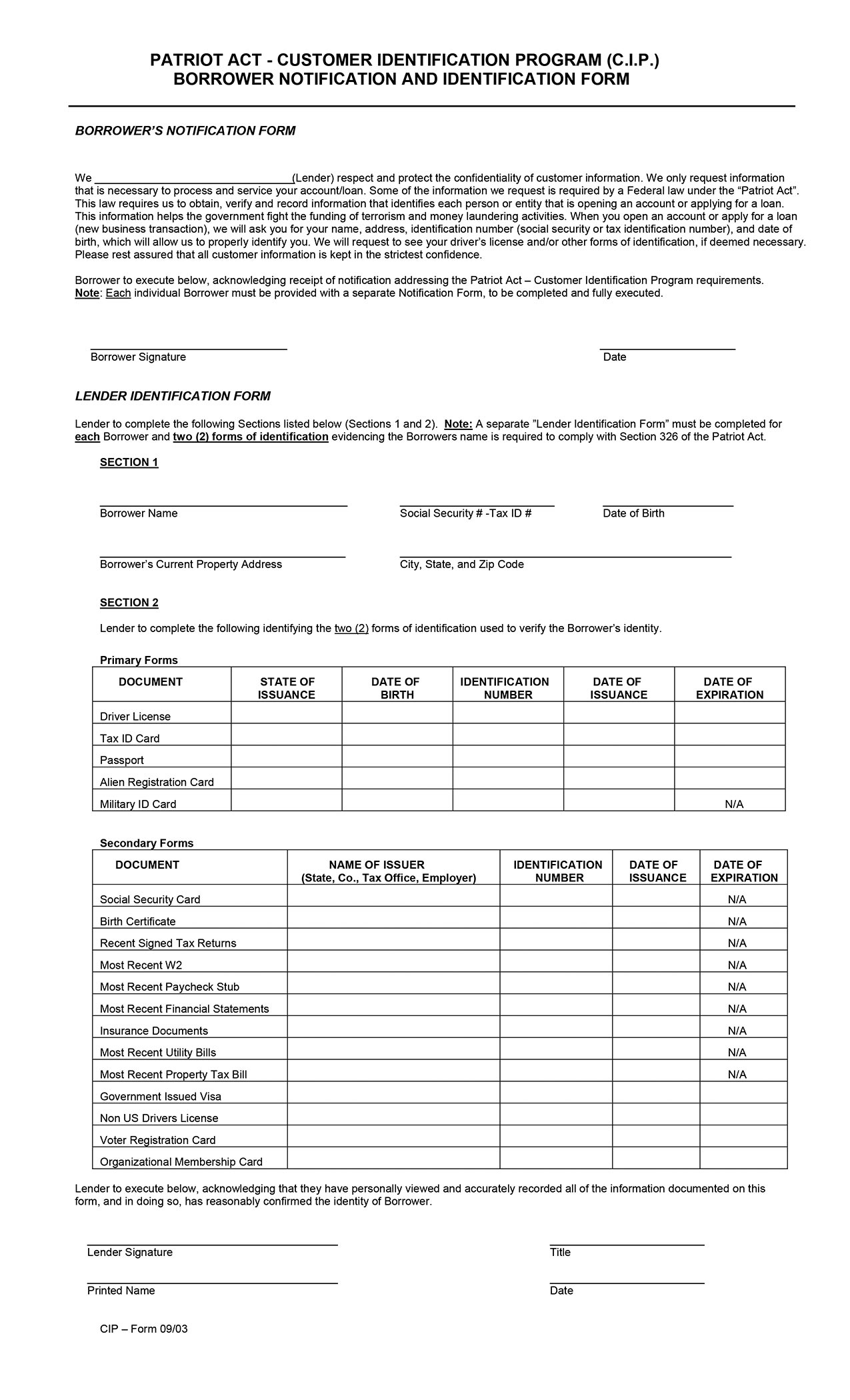

Notary Signing Agent Document Faq Usa Patriot Act Cip Forms Nna

Didn T The Internet Tax Freedom Act Itfa Ban Taxes On Sales Over The Internet Sales Tax Institute

How To Start An Llc In Texas Tx Llc Application Zenbusiness Inc

Didn T The Internet Tax Freedom Act Itfa Ban Taxes On Sales Over The Internet Sales Tax Institute

Texas Sales Tax Small Business Guide Truic

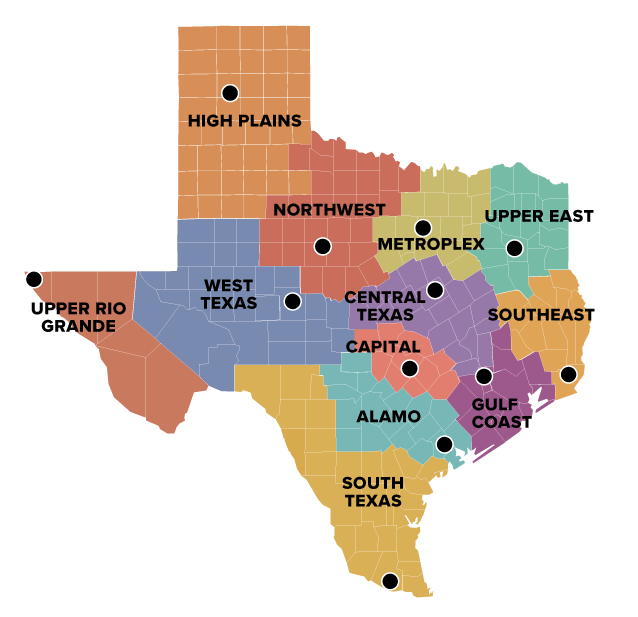

Texas Broadband Development Office

Sales Taxes In The United States Wikipedia

Notary Signing Agent Document Faq Usa Patriot Act Cip Forms Nna

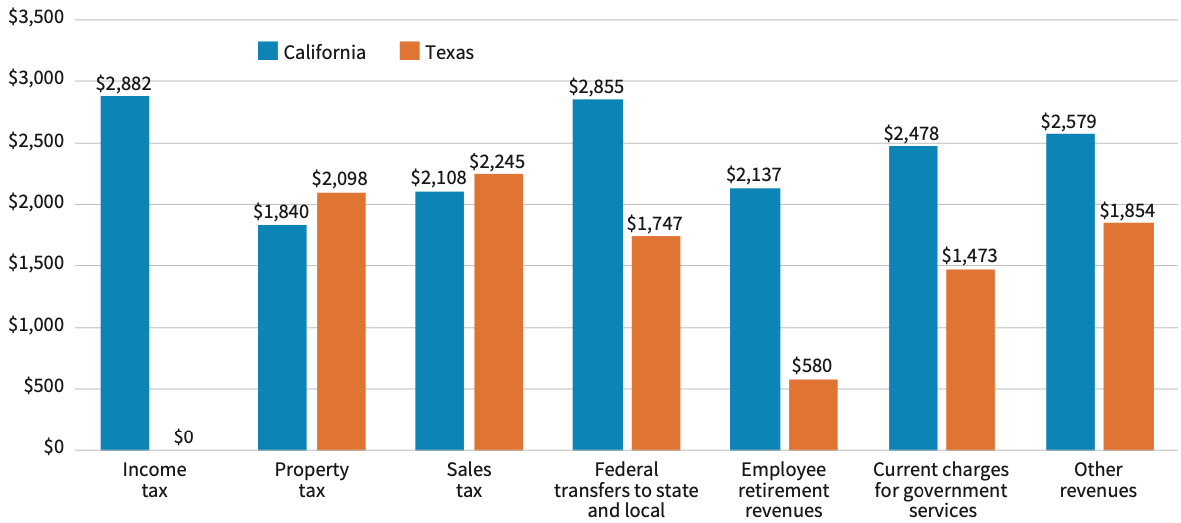

A Tale Of Two States Contrasting Economic Policy In California And Texas Stanford Institute For Economic Policy Research Siepr